Prosecutor in Bankman-Fried Case Made a Career of White-Collar Cases

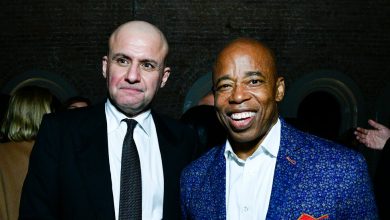

Damian Williams, the federal prosecutor overseeing the case of Samuel Bankman-Fried, has been in office only 14 months but he has already handled a series of white-collar prosecutions. When a reporter asked at a news conference on Tuesday where the new case ranked in a district that had prosecuted people like Bernard Madoff, the infamous Ponzi schemer, Mr. Williams said it was hard to compare.

“But I think it’s fair to say,” he added, “that by anyone’s lights, this is one of the biggest financial frauds in American history.”

The case is a natural for the U.S. attorney’s office for the Southern District of New York, which Mr. Williams heads and whose jurisdiction includes Wall Street. Before Mr. Williams was appointed by President Biden last year, he was a prosecutor in the district for nearly a decade, most recently helping to run a special unit that investigates fraud in the financial markets.

Mr. Williams, the first Black prosecutor to lead the storied office in its more than 230-year history, was born in Brooklyn to parents who immigrated to the United States from Jamaica. He is a graduate of Harvard University and Yale Law School. In 2007-8, he was a law clerk to Merrick B. Garland, who was a U.S. appeals judge in Washington at the time and is now the attorney general. Mr. Williams then clerked for Justice John Paul Stevens of the U.S. Supreme Court, and later practiced as an associate at the law firm Paul Weiss in New York.

As an assistant U.S. attorney, Mr. Williams helped to win the conviction of Sheldon Silver, the former Democratic speaker of the New York State Assembly, on corruption charges. Mr. Williams also helped to prosecute Chris Collins, a former Republican congressman from western New York, who pleaded guilty in an insider trading case. (He was later pardoned by President Donald J. Trump.)

On Tuesday, Mr. Williams acknowledged that the charges against Mr. Bankman-Fried had come quickly, just a month after the collapse of FTX, the cryptocurrency exchange he had founded, which destroyed billions of dollars in customer value overnight.

He said his office, along with the F.B.I., the Securities and Exchange Commission and the Commodity Futures Trading Commission had been “working around the clock to figure out what happened and to begin the process of seeking justice.”

Mr. Williams noted that the investigation was moving very quickly. “But I also want to be clear about something else,” he said. “While this is our first public announcement, it will not be our last.”