China’s Top Art Investor Amassed a Big Collection. Now He’s Selling.

Few Chinese art collectors have made a bigger splash at global auctions in the past decade than Liu Yiqian, a former Shanghai taxi driver who amassed a fortune through big bets on Chinese real estate and pharmaceutical stocks.

He was a profligate purchaser of Chinese antiquities and other artworks. In 2014, Mr. Liu paid a record $36.3 million for an ancient Chinese porcelain cup, and $45 million for a 600-year-old silk wall hanging. He paid $170.4 million for Amedeo Modigliani’s risqué “Nu Couché” painting a year later. One Shanghai museum was not enough to display the private collection that Mr. Liu amassed with his wife, Wang Wei. They built a second one nearby and a third in Chongqing in western China.

Now Mr. Liu and Ms. Wang have surprised the art world by sending 40 artworks for auction by Sotheby’s on Thursday evening in Hong Kong. The works to be sold include another Modigliani painting, “Paulette Jourdain,” which Sotheby’s had sold for $42.8 million in 2015.

Also going on the block will be a René Magritte painting, “Le Miroir Universel,” with an estimated price of $9 million to $12 million, and a David Hockney painting, “A Picture of a Lion,” with an estimated price of $5.4 million to $7 million.

Sotheby’s predicted that “Paulette Jourdain” would sell this time for “in excess of $45 million,” and that the overall auction would raise between $95 million and $135 million.

Sotheby’s said the auction will be the largest from a single owner that the auction house has held in Asia. It is also the first large public auction the couple has held for their art, although it is common for art collectors in China to do considerable private trading.

The couple’s decision to liquidate part of their collection has attracted broad attention in the Chinese art world. The auction comes as the country’s economy is slowing.

“I do hope the sale goes well, so it can boost confidence,” said Li Mi, an art market consultant in Beijing.

A woman answering the phone at the press office of the family’s museum, the Long Museum, declined to comment on the sale and said the museum had no information about it. Calls and text messages to Mr. Liu’s mobile phone and a note to his personal WeChat messaging account were not answered, nor was a note to Ms. Wang’s WeChat account. Sotheby’s declined to forward questions to the couple.

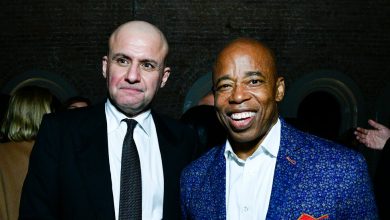

“The couple feels like it is now time to offer a small fraction of their holdings to collectors who will continue to treasure them, just as they have,” Nicolas Chow, the chairman of Sotheby’s Asia, said in a statement to The New York Times.

It’s not clear why Mr. Liu and Ms. Wang are selling. The auction comes at a delicate time for China’s economy. Growth is slowing and Chinese stocks have been declining since early May. Many investors are cautious as a housing crisis unfolds with the bankruptcy filing of Evergrande, the world’s most indebted real estate developer. Country Garden, one of China’s biggest developers, is struggling to pay its debts and to complete buildings.

The auction is being held on a quick timetable. The art was shown in Shanghai on Aug. 30-31 and in Beijing on Sept. 3-4.

Two businesses that Mr. Liu and his family built over the years have recently run into difficulty.

Mr. Liu and his family helped build one of China’s largest art auction houses, the Beijing Council International Auction Company. In 2016, Beijing Council was acquired by Jiangsu Hongtu High Technology, an electronics retailer in which Mr. Liu and his family held the second-largest stake.

Beijing Council shut down at the start of 2020, as the Covid pandemic began, and has not resumed auctions.

Jiangsu Hongtu disclosed this April that the China Securities Regulatory Commission had investigated the company and its largest shareholder, the Sanpower Group. The regulator found that Jiangsu Hongtu and Sanpower together had falsified Jiangsu Hongtu’s financial results from 2017 through 2021, Jiangsu Hongtu said.

Mr. Liu and his family were not implicated or punished by regulators, who fined the companies and said they would ban some Sanpower executives from financial markets. Calls to Sanpower and Jiangsu Hongtu went unanswered on Wednesday, when most businesses in China were closed for a holiday.

The Shanghai Stock Exchange delisted Jiangsu Hongtu this summer from trading, declaring that the company’s share price had fallen below the regulatory minimum price for more than 20 consecutive trading days.

The Chinese art market enjoyed a heyday before Xi Jinping became China’s top leader in 2012. Under his predecessor, Hu Jintao, a common form of corruption involved government officials who put obscure artworks up for auction. Companies seeking government contracts would bid and pay exorbitant sums, transferring money through auction houses to officials who would then award government construction projects to whoever paid the highest price at the auction.

Mr. Xi began cracking down on corruption when he took office, a process still underway that some analysts have described as a method he has used to consolidate power.

More recently, the country has played a less prominent role in the global art market. The United States moved ahead of China last year as the world’s largest marketplace for old masters, according to an annual report by ArtBasel. Sales of such artworks in China halved last year to $255.2 million, their lowest level since 2008 and a quarter of their peak in 2011 of $1.1 billion.

Sotheby’s said that art demand is still strong in China, and that it has had a record number of bidders and buyers from China so far this year.

One of the two Shanghai museums built by Mr. Liu and Ms. Wang has been closed this year. Traveling exhibitions fill almost all of the other museum, instead of the couple’s collection.

Mr. Liu, 60, won fame as a collector of two separate categories of art, Chinese antiquities and more recent works. He took pride in publicly buying Chinese antiquities at Hong Kong art auctions, like the ancient porcelain cup, and bringing them back to Shanghai as a nationalistic gesture.

That strategy may limit his options now. His sale on Thursday is confined to modern and contemporary paintings, including many from the West and Japan, which can be much more quickly and easily liquidated by Chinese collectors than Chinese antiques.

Mainland China enforces a complete ban on the export of Chinese art produced before the end of imperial rule in 1911. There are also many restrictions on the export of art produced from 1911 until the Communist Party took power in 1949.

The export restrictions include not allowing the shipment of these artworks to Hong Kong, which China reclaimed from Britain in 1997 but which retains separate immigration and customs regulations.

Hong Kong also does not tax fine art transactions, while mainland China imposes taxes that can total nearly 40 percent. Many wealthy Chinese art collectors buy art in Hong Kong but then leave it in storage there, showing photos of it to friends on their cellphones.

Siyi Zhao and Li You contributed research.