Lessons From the ’80s, When Volcker Reigned and Rates Were High

The cost of living is sky-high, and the chair of the Federal Reserve says that battling it is his highest priority. Financial markets don’t know quite how to react.

That, in a nutshell, is the situation now, with Jerome H. Powell, the Fed chair, raising interest rates to damp down inflation that hasn’t been this high in 40 years.

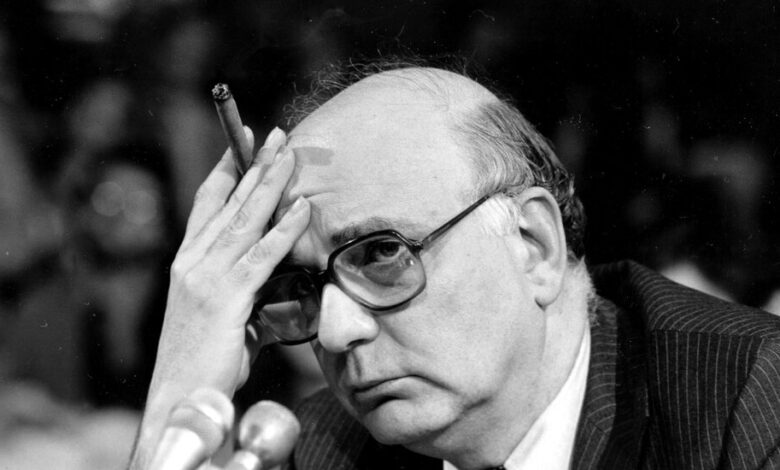

Something similar happened the last time inflation was out of control. Paul A. Volcker was the Fed chair then. He wrung inflation out of the economy, but at a great cost — hurling the nation into not just one recession, but two, in rapid succession. Unemployment soared, stocks fell repeatedly, interest rates oscillated and, for a while, bonds looked shaky, too.

While comparisons between the periods can be overdrawn, there are parallels. And because of the outsize role that Mr. Volcker has come to play as the very model of a modern central banker, it’s worth looking at his era for guidance. The Federal Reserve has turned to the historical record for lessons. Investors can also benefit from them.

Simply put, I’d say the lessons are twofold.

First, because it had multiple, severe downturns, the Volcker era was disastrous for anyone who traded actively and bet wrong on the direction of the markets. Short-term trading in stocks, bonds and commodities is a hazardous game. It’s especially dangerous when the market’s currents are opaque and treacherously strong, as they were back then and may be now.

But, second, the Volcker era was wonderful for those with the patience and resources to ride it out. While Mr. Volcker’s stern treatment of the economy was deliberately disruptive, it ushered in awesome bull markets, in both stocks and bonds.

Then, and now

Investing would be easy if we knew how the current era would look in 40 years. But, of course, we don’t.

Consider that the S&P 500 fell more than 20 percent from Jan. 3 through mid-June this year — putting stocks into a bear market — only to rebound more than 12 percent. Stocks are still down significantly, and the bear market designation will remain intact until the market returns to its peak.

But when will that take place?

That’s a crucial question if you’re making short-term bets. It’s far less important if you’re a long-term buy-and-hold investor, with a horizon of at least a decade and preferably longer, using cheap index funds that track the entire market.

That’s the approach that I take now, and that I think makes sense for most people — assuming, of course, that you are able to put away enough money to pay your bills, so the temporary, paper losses you experience in the market won’t hurt you. As long as the market eventually rises, you will prosper.

8 Signs That the Economy Is Losing Steam

Worrying outlook. Amid persistently high inflation, rising consumer prices and declining spending, the American economy is showing clear signs of slowing down, fueling concerns about a potential recession. Here are other eight measures signaling trouble ahead:

Retail sales. The latest report from the Commerce Department showed that retail sales fell 0.3 percent in May, and rose less in April than initially believed.

Consumer confidence. In June, the University of Michigan’s survey of consumer sentiment hit its lowest level in its 70-year history, with nearly half of respondents saying inflation is eroding their standard of living.

The housing market. Demand for real estate has decreased, and construction of new homes is slowing. These trends could continue as interest rates rise, and real estate companies, including Compass and Redfin, have laid off employees in anticipation of a downturn in the housing market.

Start-up funding. Investments in start-ups have declined to their lowest level since 2019, dropping 23 percent over the last three months, to $62.3 billion.

The stock market. The S&P 500 had its worst first half of a year since 1970, and it is down nearly 19 percent since January. Every sector of the index beyond energy is down from the beginning of the year.

Copper. A commodity seen by analysts as a measure of sentiment about the global economy — because of its widespread use in buildings, cars and other products — copper is down more than 20 percent since January, hitting a 17-month low on July 1.

Oil. Crude prices are up this year, in part because of supply constraints resulting from Russia’s invasion of Ukraine, but they have recently started to waver as investors worry about growth.

The bond market. Long-term interest rates in government bonds have fallen below short-term rates, an unusual occurrence that traders call a yield-curve inversion. It suggests that bond investors are expecting an economic slowdown.

The Volcker era illustrates the problem emphatically. Over the long haul, investors did fine. Over short periods, their experience was maddening.

Extraordinary shifts

Mr. Volcker became Fed chair on Aug. 6, 1979, as an appointee of President Jimmy Carter, and served until Aug. 11, 1987, under President Ronald Reagan.

That period and the current one are by no means identical. In monetary policy alone, the causes of the great inflation then and the big one now stem from different, though superficially similar, roots.

There were oil price shocks in both periods: one in 1973 and 1974 and another in 1978 and 1979; as well as the oil price shock of 2022.

But the impetus for the great inflation of the 1970s and 1980s goes back at least to the mid-1960s, to President Lyndon B. Johnson’s “guns and butter” spending on the Vietnam War and the Great Society, which the Federal Reserve accommodated with loose monetary policies.

In addition, Congress took the United States off the gold standard in 1968. And on Aug. 15, 1971, President Richard M. Nixon suspended the convertibility of the dollar to gold for foreign governments, which, until then, could obtain it from the U.S. government at $35 an ounce.

It’s little remembered that Mr. Volcker himself, as under secretary for monetary affairs at the U.S. Treasury, recommended that Nixon take that step, and that Mr. Volcker oversaw the start of the floating exchange rates that we now take for granted. The dollar weakened sharply in response to the Nixon-Volcker policies, adding to the inflation that Mr. Volcker would later combat at the Fed.

When Mr. Volcker became Fed chair in 1979, inflation was running above 11 percent annually, and the unemployment rate was almost 6 percent. A bull market in stocks had started in 1974 and it continued months more, even though the Volcker Fed had begun to tighten monetary policy with a remarkable shift in approach — one that makes current efforts look paltry.

On Saturday, Oct. 6, 1979, Mr. Volcker “announced a radical change in the implementation of monetary policy,” Jeremy J. Siegel, the University of Pennsylvania economist, wrote in the book “Stocks for the Long Run.”

“No longer would the Federal Reserve set interest rates to guide policy,” Professor Siegel said. “Instead, it would exercise control over the supply of money without regard to interest rate movements. The market knew that this meant sharply higher interest rates.”

By reducing the money supply, and letting short-term interest rates float, the Fed was, effectively, letting rates spiral upward.

The immediate stock market reaction was severe.

“Stocks went into a tailspin, falling almost 8 percent on record volume in the 2½ days following the announcement,” Professor Siegel wrote. “Stockholders shuddered at the prospect of sharply higher interest rates that would be necessary to tame inflation.”

By March 1980, the Fed funds rate was an astonishing 17 percent, compared with just 2.5 percent today. It would exceed 19 percent the following year — and the money supply, which was the Fed’s main target, was shrinking sharply.

Yet despite periodic short-term declines, many stock market traders remained bullish. They were either oblivious to the implications of this extreme monetary tightening or in denial about them.

Those implications were all too clear for millions of people who lost their jobs, however. The economy slowed so much that it fell into a recession from January through July 1980.

But it wasn’t until Nov. 28, 1980, that a bear market in stocks began. What explains the timing of the market’s moves back then? Even now, we can’t say for sure.

What is clear is that the S&P 500 lost more than 27 percent during a miserable 20-month period that ended in August 1982. If you were on the wrong side of that move, you lost a ton of money.

A premature victory

Making sense of the Fed’s plans was impossibly difficult because the Fed itself wasn’t sure how to proceed. It began looseningmonetary policy — prematurely, as it turned out — in April 1980, during the first Volcker recession. Minutes of Fed meetings, and contemporaneous Fed histories reveal that the central bank was improvising. It was trying to reduce “inflation expectations” while minimizing harm to those whose livelihoods were at stake, and often didn’t know how to balance the two imperatives.

The effective Fed funds rate reached 19.39 percent in April 1980, only to fall to 11 percent in May and 9 percent in July. The Fed had to reverse course in September. By January 1981, with inflation surging, the Fed funds rate was again above 19 percent. That’s not a typo.

The textbooks predict that when you raise interest rates high enough, an economy will sputter, and that’s what happened:The secondVolcker recession began in July 1981 and lasted until November 1982.

Still, that made Mr. Volcker’s task easier. There was no longer any reason to doubt that the Fed meant business. Another recession? Bring it on! Anything it took, as long as it stifled inflation. As William L. Silber, the New York University economist, says in “Volcker: The Triumph of Persistence”: “His leadership of the Federal Reserve from 1979 through 1987 revived confidence in the central bank — almost as though he had restored the gold standard — and ushered in a generation of economic stability.”

Wild trading

Trading stocks, bonds and commodities like gold during this volatile period was exciting but excruciating. Countless, supposedly well-informed “experts” recommended buying and selling stocks at the wrong moments. Millions of people lost money.

The State of Jobs in the United States

Employment gains in July, which far surpassed expectations, show that the labor market is not slowing despite efforts by the Federal Reserve to cool the economy.

- July Jobs Report: U.S. employers added 528,000 jobs in the seventh month of the year. The unemployment rate was 3.5 percent, down from 3.6 percent in June.

- Care Worker Shortages: A lack of child care and elder care options is forcing some women to limit their hours or has sidelined them altogether, hurting their career prospects.

- Downsides of a Hot Market: Students are forgoing degrees in favor of the attractive positions offered by employers desperate to hire. That could come back to haunt them.

- Slowing Down: Economists and policymakers are beginning to argue that what the economy needs right now is less hiring and less wage growth. Here’s why.

Short-term gains — and losses — were spectacular. Gold sold for $282.70 an ounce on the day Mr. Volcker took office. It reached $850 five months later, on Jan. 21, 1980 — and wouldn’t flirt with this lofty price again until the financial crisis of 2008, 28 years later. (That history is one of the reasons I’ve stayed away from gold in recent years.)

If you didn’t pay attention to the fact that inflation was eating away at the value of your investments, the numbers were fantastic. Here are some, compiled by the Federal Reserve Bank of St. Louis. Six-month certificates of deposit carried yields of more than 18 percent in March 1980, but mortgage rates were mind-bogglingly high, too, averaging 18.6 percent in October 1981. In August 1981, three-month Treasury bills carried a yield of more than 15 percent and money market funds were much in vogue. But those yields declined to single-digit levels by 1984, when inflation was back under control.

Fabulous over the long run

Trading was all a matter of timing, which nobody gets right all of the time.

That’s why I avoid it. Instead, I try to stay humble, accept long-term market returns, and just carry on, despite short-term losses.

If you hung in during the entire Volcker era, you experienced turmoil but went on to enormous gains in both stocks and bonds. From the day Mr. Volcker took office until the day he left, shares in the Vanguard S&P 500 stock index fund — the first low-cost broad index fund available to ordinary investors — would have gained 215 percent, according to FactSet data.

An index of the broad bond market, now known as the Bloomberg U.S. Aggregate, would have gained 143 percent in that period. And on the day Mr. Volcker started as Fed chair, the 30-year U.S. Treasury bond provided a yield of more than 9 percent — a guaranteed doubling of your money every eight years, if you had just held onto it. Even better, you could have bought a Treasury bond in September 1981 that paid a guaranteed 15.19 percent for 30 years; I was young then, and, sadly, did not do any of this.

But if you had been smart enough to invest in the overall S&P 500 index on Aug. 12, 1982 — in the middle of the second Volcker recession, when most people were shying away from stocks — you would have gotten in at the bottom of the bull market that lasted until Aug. 25, 1987. The modest Vanguard S&P 500 index fund gained 257 percent during that period, dividends and expenses included, according to FactSet data.

There were big ups and downs in shorter stretches, including terrible losses in the bear market. They scared me away from stocks for a while. I wish they hadn’t.

What we’ve been experiencing over the last year is frightening, too, and I don’t claim to make sense of all of it. It’s not clear whether the July rally in the stock market was more like an early sucker’s rally in the Volcker era (leading to a recession and bear market) or like the second big rally — the one that became a great bull market. Or, perhaps, it’s another variation, one I can’t imagine.

No one knows. If they say they do, run the other way or, better yet, hedge your bets with long-term investments using index funds. And remember that those long-term bets on stocks and bonds paid off, even in that era of market turmoil.