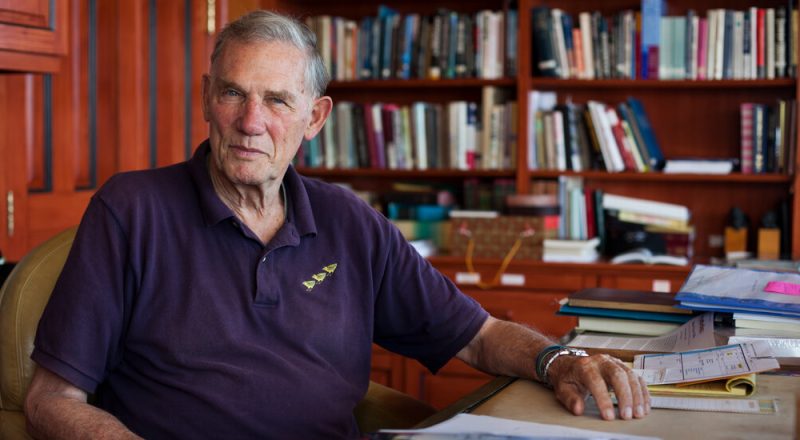

Robert A.G. Monks, a lawyer and businessman from a prominent Massachusetts family who unsuccessfully ran for the U.S. Senate three times but found a calling in his 40s as an influential defender of shareholder rights, died on April 29 at his home in Cape Elizabeth, Maine. He was 91.

The cause was pancreatic cancer, which was diagnosed about a week before his death, his son, Bobby, said.

By age 40, Mr. Monks had worked his way up to partner at the Goodwin Procter law firm in Boston, amassed a fortune running a regional oil and coal firm and other businesses, and made the first of three unsuccessful runs for U.S. senator in Maine.

While campaigning during a Republican primary there in 1972, he noticed “big, slick bubbles of industrial discharge” in a river, Mr. Monks wrote in an unpublished memoir. That and other signs of pollution made him wonder how corporate behavior could be better controlled. His answer was to persuade shareholders to assert their ownership rights by pressuring corporate executives to act more responsibly toward society at large. This epiphany, as he described it, ultimately gave him the sense of purpose and direction he had been seeking.

He pursued his activist-shareholder agenda at the U.S. Labor Department, where he was appointed in 1983 to oversee the pension system. And in 1985, Mr. Monks, with Nell Minow, founded Institutional Shareholder Services, or ISS, which advises investors on how to vote on such matters as elections of directors, compensation policies and shareholder proposals.

ISS, now majority-owned by Deutsche Börse of Germany, and a rival company, Glass Lewis, are today the largest providers of such advisory services. Their influence is such that some corporate leaders and Republican politicians, accusing the firms of pursuing “woke” agendas, have recently called for the Securities and Exchange Commission to rein them in.